Financial Reporting and Budgets

The Town of Claresholm does its best to strike a balance between providing services and maintaining facilities for the residents and businesses of our community while maintaining reasonable tax, utility and user rates. Annually, the Town prepares operating and capital budgets to help plan for our future.

We also regularly report on our past, to inform the public on how their money is being spent. This reporting is in the form of monthly financial reports to Council as well as annual audited financial statements. If you have any questions regarding the Town’s budgets or financial reporting feel free to contact the Town’s Director of Corporate Services via e-mail or by phone at 403.625.3381.

April 2023 - Municipal Comparisons

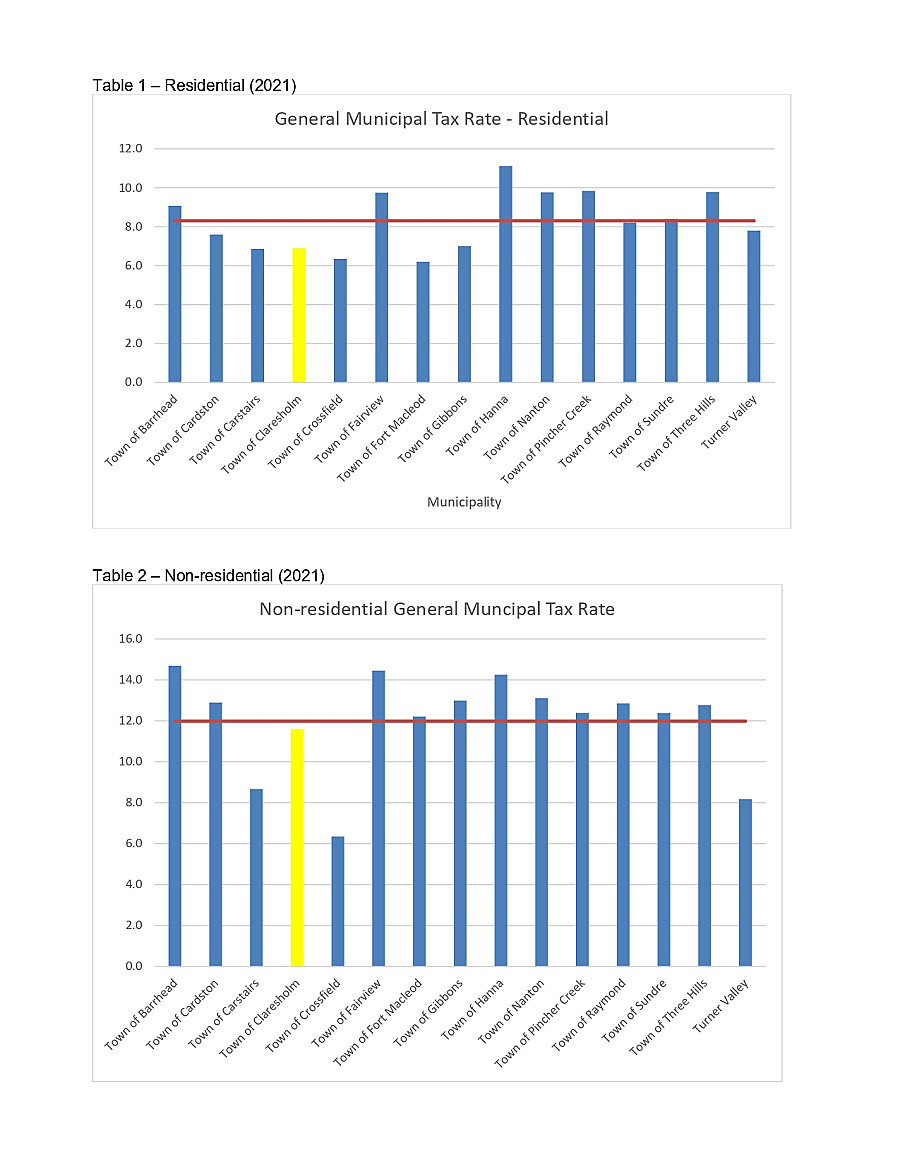

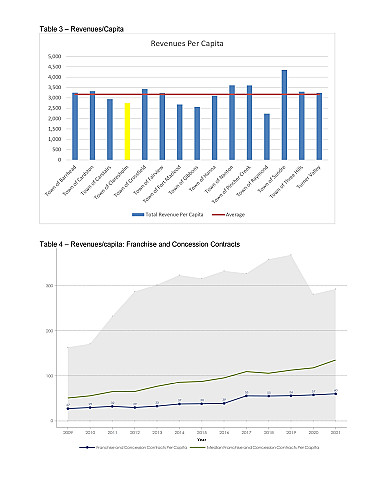

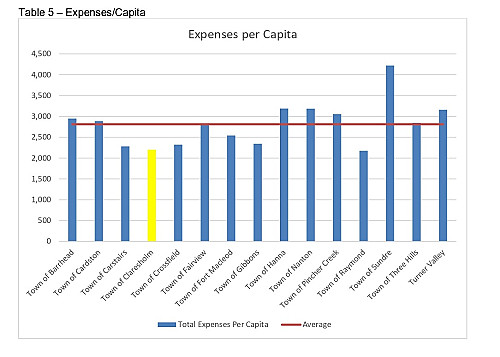

In anticipation of budget and tax rate bylaw approvals over the next several weeks, Administration has prepared municipal comparisons so Council and residents can have an idea of where Claresholm stands in relation to other municipalities.

Administration has generated tables comparing municipal residential and non-residential tax rates, and expenditures and revenues. The tables compare Claresholm with a select group of municipalities, which have been chosen based upon a municipality index provided by the province (a combination of equalized assessment, location and population). The communities in the tables below range in the municipality index from 67 (Turner Valley) to 73 (Carstairs). Claresholm has an index number of 71 and the website suggests to compare municipalities with +/- 10 index points. The charts speak very broadly to municipal tax rates, and expenditures and revenues. The data in the tables is from 2021.

Tax Rates

Tax Rates

The public can also access the information and generate your own tables and comparisons by visiting the Government of Alberta website.