Tax & Assessment

Property taxes are due each year by June 30, or the last business day of June, unless you are enrolled in the Tax Instalment Payment Plan (TIPPs). The TIPPs program allows you to pay your taxes in instalments throughout the year from January to December (the 3rd of the month by direct deposit). Payments from January to May are based on your taxes from the prior year and payments from June to December are adjusted to fully pay the balance of your taxes by your December payment.

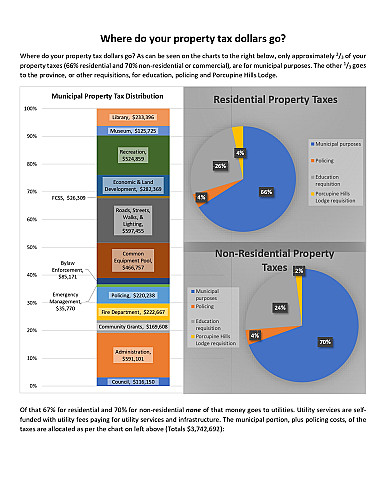

Property taxes are the primary source of municipal income to support Town administration and services. Property tax rates are set each year as part of the annual budget and are set as a “Mill Rate” which is used to calculate your annual taxes as per the formula below. Also generally included with your regular municipal property taxes are the Alberta School Foundation Fund taxes (ASFF or Education Taxes) and Home For Aged (HFA – Porcupine Hills Lodge Requisition) which are not set by the municipality, but requisitioned from the province and lodge. The exact distribution of these requisitioned taxes across property types (residential, vacant land, non-residential) are set by the Municipality.

Municipal taxes are based on property assessment market value as at July 1st of the previous year (the assessment year) and based on the condition of the property as at December 31 of the assessment year. The Town contracts Benchmark Assessment Consultants Inc. to complete the property assessments. Click the link below to access summary assessment reports for any property in Claresholm. Properties can be searched by roll number, legal description, or civic address. Instructions are:

- Click HERE

- Agree to Terms of use

- Select Municipality "Claresholm Town"

- Select Type of Access "General Public"

- Search for Property by Roll, Legal Address, or Civic Address (can be incomplete, i.e. 2nd Street, and all properties containing 2nd Street in address will be listed)

- Select to View or Download desired report

Alternatively there is a listing below of Claresholm property assessment values listed by street address for the last two years.

file

Download2022 Assessment for 2023 Taxes

file

Download2021 Assessment for 2022 Taxes

The Town of Claresholm offers the option of property owners to pay their property taxes monthly. All prior taxes must be paid in full prior to signing up. Payments are taken electronically on the 3rd of each month from January to December. Payments are adjusted accordingly in January and July each year.

Do you require a Tax Certificate or Tax Information?

Please complete one of the forms below and return it by email to info@claresholm.ca or by fax to 403-625-3869 along with confirmation of payment.

file

DownloadRequest for Tax Info

file

DownloadRequest for Assessment Info

Do you wish to appeal your property assessment? Please refer to the forms below.

Deadline to file an assessment complaint for the 2023 tax year is Tuesday, July 18, 2023 at 4:00 p.m.

file

DownloadTax Info 2023